All Info You Need To Know About Car Insurance

What is Car Insurance and Why You Need It

Car insurance is a contract between you and an insurance company that protects you financially in case of an accident. It provides coverage for damage to your vehicle, injuries to yourself or others, and property damage caused by your vehicle. Having car insurance is not only a legal requirement in most places, but it also gives you peace of mind knowing that you are protected in case of unforeseen events.

Types of Car Insurance Coverage

There are several types of car insurance coverage available, including liability, collision, comprehensive, uninsured/underinsured motorist, and personal injury protection. Liability covers damages caused by you to others, while collision coverage pays for damages to your vehicle from a collision. Comprehensive coverage protects against non-collision incidents like theft or natural disasters. Uninsured/underinsured motorist coverage provides compensation if you are involved in an accident with someone who doesn't have sufficient insurance. Personal injury protection covers medical expenses for you and your passengers.

Factors Affecting Car Insurance Premiums

Insurance companies look at various factors when calculating your car insurance premiums. These include your driving record, age, gender, location, type of car, usage, and credit history. A clean driving record, being older, and having a good credit score can help lower your premiums. Additionally, the type of coverage you choose and the deductible amount you select can also affect your premium.

Choosing the Right Car Insurance Policy

To choose the right car insurance policy, consider your personal needs and budget. Assess the level of coverage required based on the value of your vehicle and your financial situation. Compare quotes from different insurance companies to find the best rates and ensure you understand the terms and conditions of the policy before making a decision.

Understanding Deductibles and Limits in Car Insurance

A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Higher deductibles can result in lower premiums, but it's essential to choose an amount that you can afford to pay if an accident occurs. Policy limits refer to the maximum amount your insurance company will pay for a claim. Make sure you understand the limits of your policy and consider increasing them if you feel the coverage may not be sufficient.

Common Car Insurance Terms

When dealing with car insurance, it's helpful to understand common terminology. Examples include premium (the amount you pay for coverage), policy (the contract with your insurance company), claim (a request for compensation due to an accident or damage), and underwriting (the process used by insurers to assess risk and set premiums).

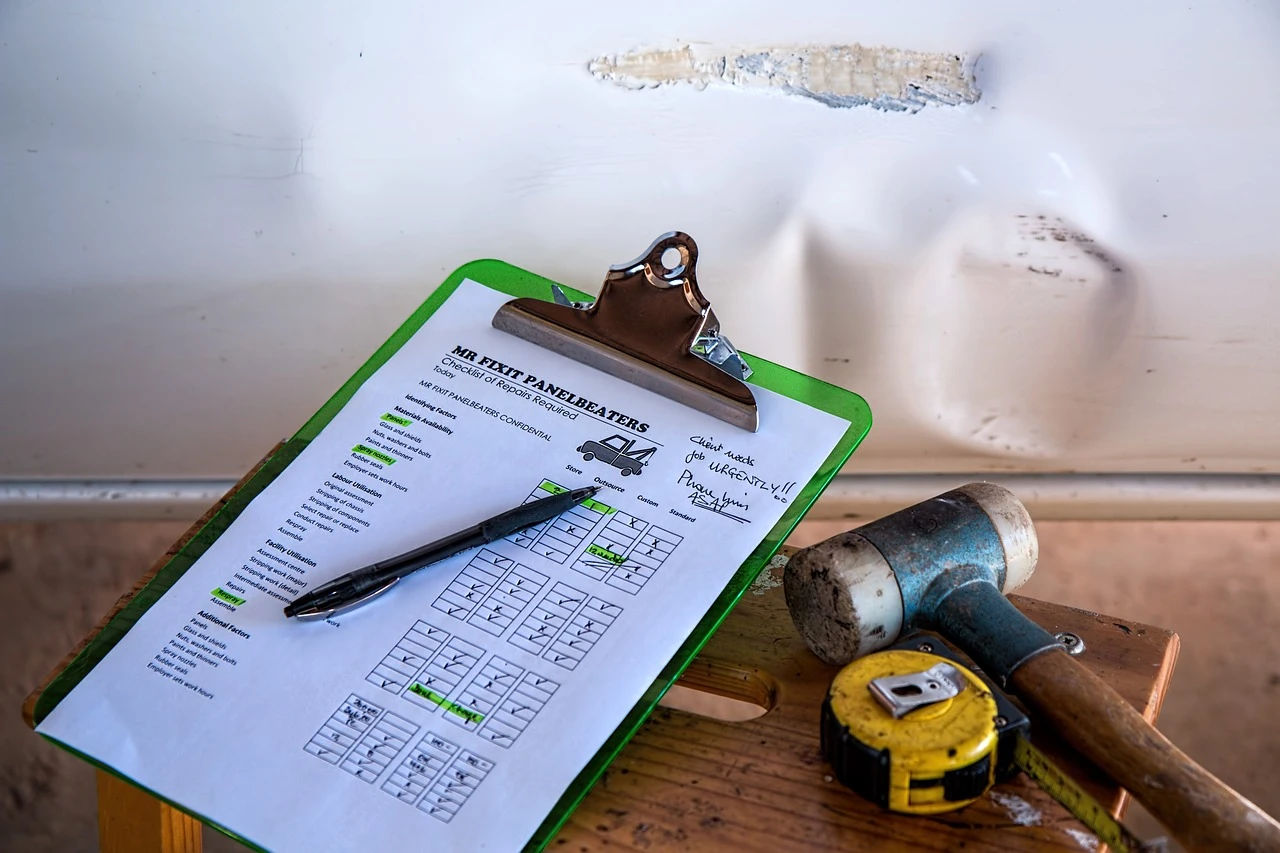

Making a Car Insurance Claim: Step-by-Step

In the event of an accident or damage, it's important to know the steps involved in making a car insurance claim. First, contact your insurance company and provide all relevant details about the incident. Take photos as evidence if possible and obtain any necessary documents. Your insurance company will guide you through the claim process, including assessing damages, providing repair estimates, and arranging payment.

Saving Money on Car Insurance: Tips and Discounts

There are several ways to save money on car insurance. Consider bundling your car insurance with other policies from the same company, maintaining a clean driving record, taking defensive driving courses, installing safety features in your vehicle, and increasing your deductibles. You may also be eligible for discounts based on your age, occupation, or membership in certain organizations. Review your policy regularly and shop around for better rates to ensure you are getting the most value for your money.

All Info You Need To Know About Car Insurance

Unlocking the Road to Car Insurance Knowledge: Your Ultimate Guide to Coverage, Premiums, and Savings! Learn all the insider tips on finding the perfect policy, making hassle-free claims, and scoring fabulous discounts, all while safeguarding your precious wheels. Get ready to hit the road with confidence!

Why Kaiser Permanente is a good choice for auto insurance?

Discover why Kaiser Permanente stands out as an excellent choice for auto insurance with comprehensive coverage options and top-rated customer service.

How to find the best auto insurance company in US?

Discover the top tips for finding the best auto insurance company in the US and secure optimal coverage for your vehicle.

Geico Car Insurance Review for 2024

Discover the latest insights on Geico car insurance for 2024, including coverage options, customer satisfaction, and what sets them apart in the competitive insurance market.

What Will Self-driving Cars Influence The Future Of Auto Insurance

Discover how self-driving cars are set to revolutionize the future of auto insurance. Uncover the exciting possibilities and potential changes that this technology will bring, ensuring you stay ahead in an ever-evolving automotive landscape.